- Open Banking

- Aggregate your account info into real-time dashboard

so you can manage all your money in one place.

Open Banking

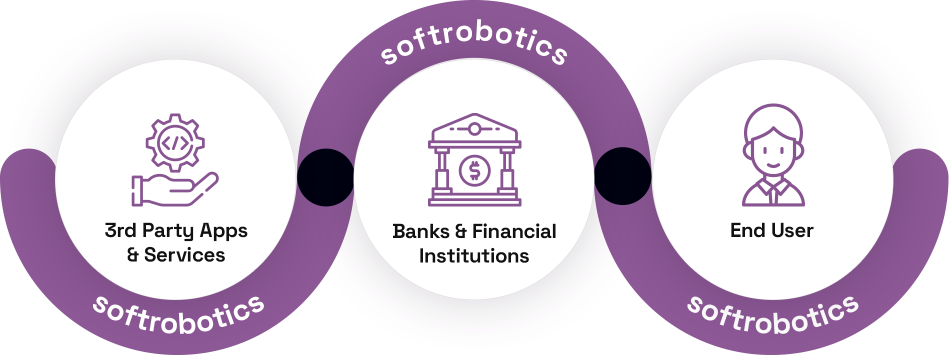

Open banking is a banking practice that provides 3rd party financial service providers open access to consumer banking, transaction, and other financial data from banks and non-bank financial institutions through the use of (APIs).

Unlock The Power Of Open Banking

Access end-users’ bank data from all accounts in a unified, easy-to-read format.

With all PSD2 requirements covered, offering a cost-effective and technically scalable approach to compliance.

Make payments faster and more secure, by allowing end-users to initiate them straight from their bank accounts.

Access end-users’ bank data from all accounts in a unified, easy-to-read format.

Transform raw data into actionable insights powered by machine learning.

Get TPP’s regulatory status checked in a split of a second.

Frequently Asked Questions About Open Banking

What are the benefits of Open Banking?

Open Banking is designed to: Expand your market choices, empower you with increased control over your finances and the discretion to choose who accesses your account data, and enhance accessibility to a wider array of services offered by diverse financial service providers.

Is Open Banking secure?

Financial institutions and Third-Party Providers (TPPs) in Open Banking are required to adhere to data protection regulations. TPPs must be either registered with or licensed by the CBB, and each TPP must obtain your explicit consent prior to accessing your account(s) through Open Banking.

Is Open Banking free?

Access to open banking APIs offered by banks is free of charge. However, third-party providers are required to obtain specific licenses, involving significant financial investments, for utilizing these APIs. As a result of these licensing costs, TPPs may frequently impose fees for accessing their products and services.

How do Open Banking APIs work?

An open banking Application Programming Interface (API) facilitates the secure transmission of data from a bank account to an authorized and regulated third-party provider (TPP). With the consent of the data holder, these TPPs can subsequently access certain information from the bank.